In this project, we analyze the role of fiscal and monetary policies in the determination of inflation and government debt in Mexico during the 1981-2016 period. We identify five different periods of fiscal and monetary policy interactions, which are congruent with a historical account of the Mexican monetary and fiscal policy mix. Counterfactual exercises showContinue reading “Monetary and Fiscal Policies Interactions in Mexico”

Category Archives: Sin categoría

What was the role played by the inflation formation processes, monetary policy, and shocks volatilities in the inflation dynamics of Brazil, Chile, Colombia, Mexico, and Peru?

In this presentation (https://lnkd.in/gupfXu85) we analyze the role played by monetary policies, inflation determinants, and shocks. We allow for endogenous structural breaks and classify regimes according to (1) the relative weight of inflation in an interest rate reaction function, which measures the Central Bank’s commitment to fight inflation, (2) the relative slope of the PhillipsContinue reading “What was the role played by the inflation formation processes, monetary policy, and shocks volatilities in the inflation dynamics of Brazil, Chile, Colombia, Mexico, and Peru?”

Why bonds’ prices drop when interest rates increases? and why longer tenor’s bonds have larger drops in prices?

The price of a bond, which gives the owner rights over future cash flows, should be equal to the present discounted value of those cash flows. The interest rates that guarantees the equality of cash flows and price of bonds is defined as the yield rate. Bonds’ prices and yield rates are inversely related. WhenContinue reading “Why bonds’ prices drop when interest rates increases? and why longer tenor’s bonds have larger drops in prices?”

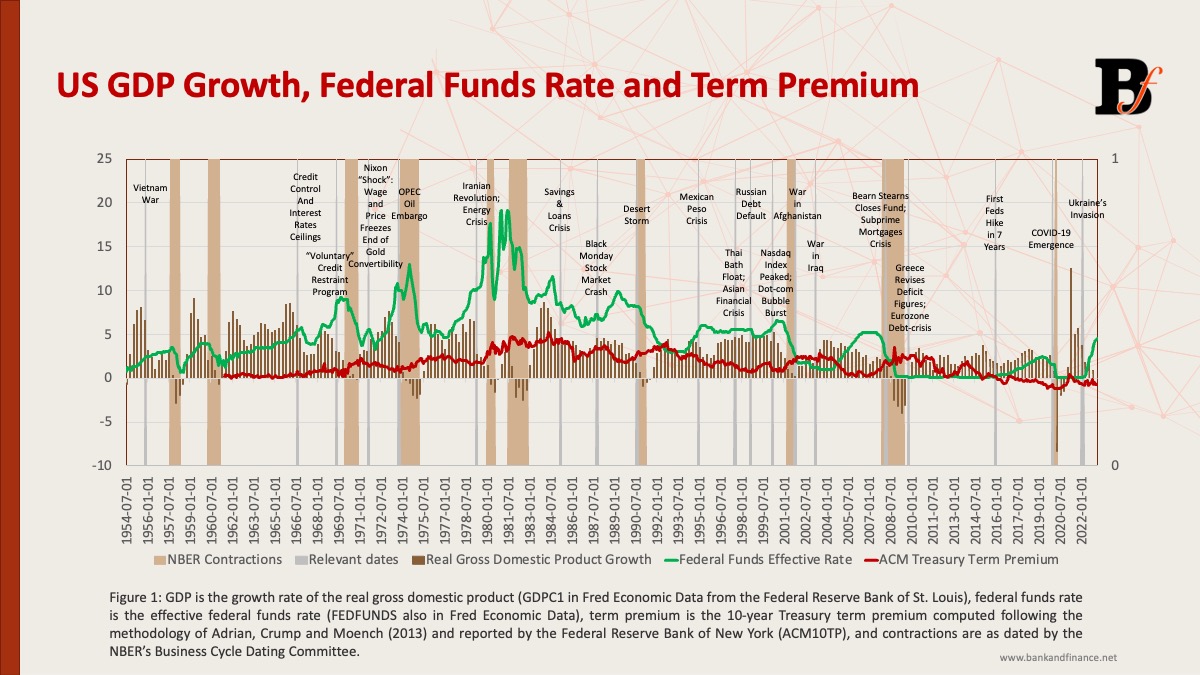

Financial conditions and monetary policy: the importance of non-linear effects

In this research project, we show the importance of considering non-linearities when analyzing financial conditions and the macroeconomic-financial linkages. Conclusions include:

Measuring corruption

Measuring corruption is challenging because participants have incentives to hide it. According to the United Nations, annual costs from corruption are estimated at 5% of Gross Domestic Product (GDP). The IMF (2016) estimates that the annual cost of bribery is 2% of GDP and according to IMF (2019) corruption reduces tax income in at leastContinue reading “Measuring corruption”