Government borrowing could respond to intertemporal allocation of public resources to smooth expenditure, investment, and taxation. It allows expediting the investment process to foster economic growth and helps in economic stabilization. According to Eichengreen et al. (2019), sovereign debt has a long history with evolving nature and dynamics. Debt before the 19th century was mainlyContinue reading “Evolution of central government debt instruments around the world 1995 – 2021”

Author Archives: Alberto Ortiz

How did net creditor and net debtor countries perform between 2019 and 2021?

The net international investment position (NIIP) provides an aggregate view of the net financial position (assets minus liabilities) of a country vis-à-vis the rest of the world. During the 2019 – 2021 period, NIIP has exhibited important changes with many of the main net creditors (as Japan, Germany, Hong Kong, Norway, Singapore, Netherlands, Switzerland, and Canada)Continue reading “How did net creditor and net debtor countries perform between 2019 and 2021?”

The Financial Accelerator Mechanism Redux

Ben Bernanke, together with Mark Gertler, has advocated to study the importance of financial factors in economic allocations. In particular, the misallocations created by asymmetric information. In their American Economic Review (1989) paper (https://lnkd.in/gF3r6zq7) titled Agency Costs, Net Worth and Business Fluctuations, they introduced the financial accelerator mechanism through which small shocks get amplified dueContinue reading “The Financial Accelerator Mechanism Redux”

High inflation and relatively low interest rates around the world

These levels are, on average, 6% higher than the levels observed in 2019. Production and distribution disruptions are part of the supply side considerations behind the global surge of inflation. However, demand side factors, as the strong fiscal stimulus implemented to counteract the negative effects of COVID-19, and low interest rates, are also part ofContinue reading “High inflation and relatively low interest rates around the world”

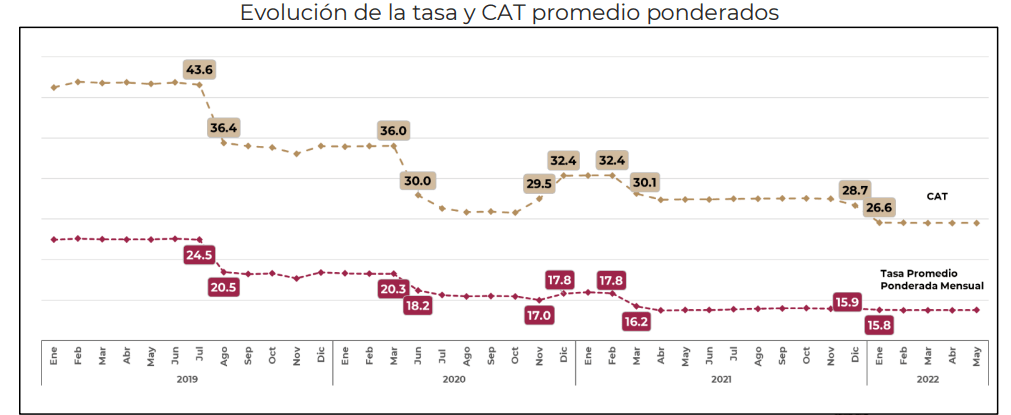

Public consumer credit

Credit markets are prone to information asymmetries, which could cause inefficiencies such as credit rationing and exclusion. In general, private institutions could have advantages to find solutions to overcome these information problems. In some cases, due to the nature of the information problem or of the legal and regulatory framework, a carefully designed and operatedContinue reading “Public consumer credit”